Student Loan Data Visualization

Challenge

Most users enrolled in the program once and never came back.

Goal

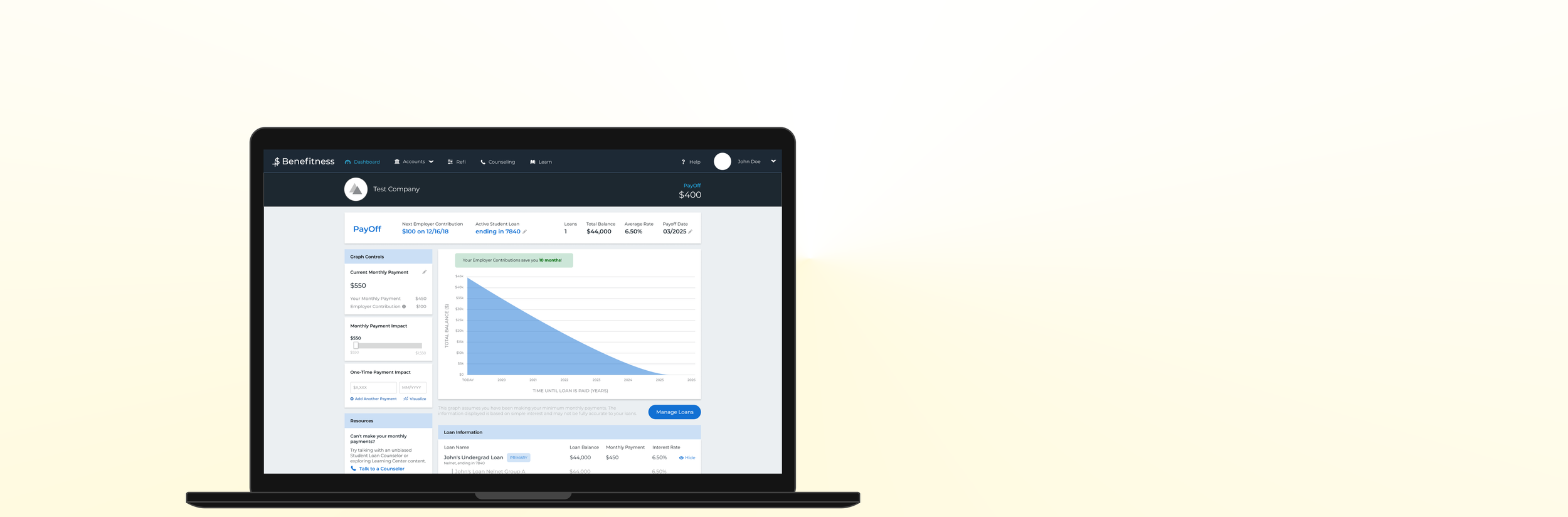

Create a reason to return by helping users understand their loans and take meaningful action.

Role Lead Product Designer

Industry Fintech, Employer HR Benefit

Timeline ~10 weeks (MVP), extended iteration post-launch

Tools Figma, Mouseflow, Google Analytics

The Problem

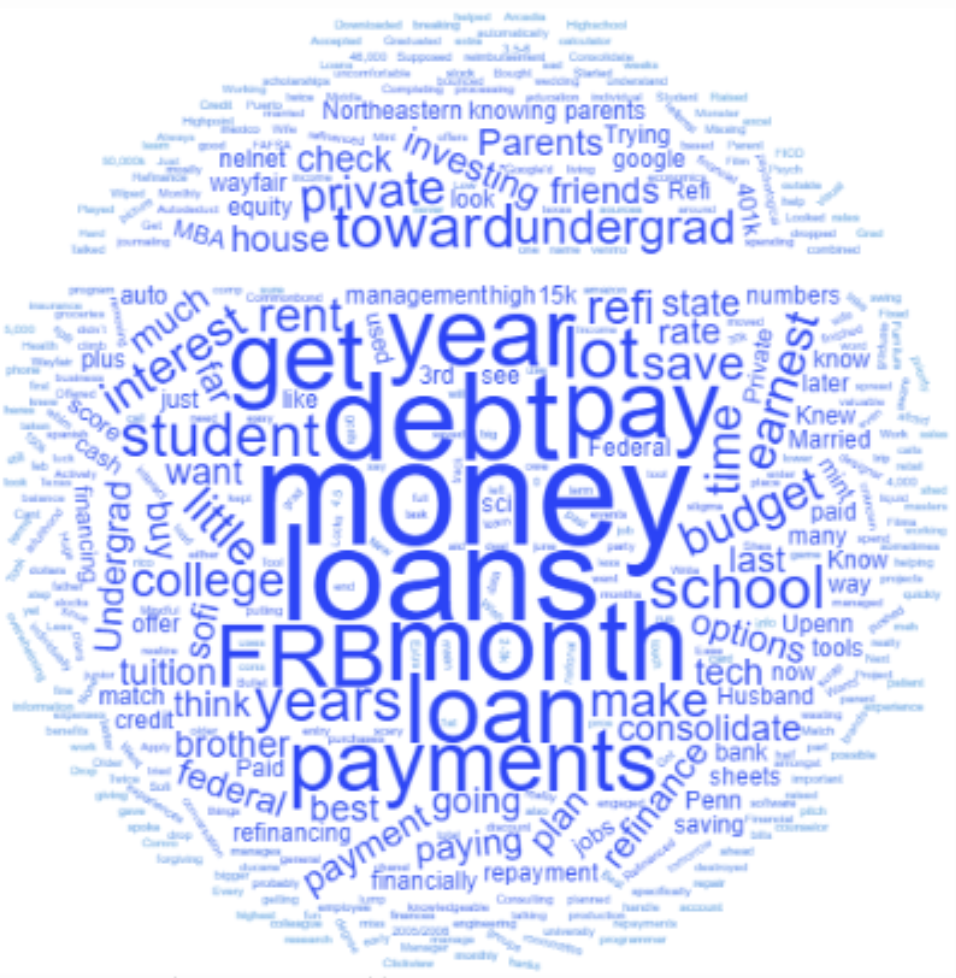

What we learned:

Users felt confused, overwhelmed, or emotionally detached from their loans.

They didn't know what to do after logging in.

50% saw it as automatic, out-of-sight/out-of-mind.

25% were overwhelmed, 25% were taking proactive steps—but lacked tools.

Quote:

“It’s like what my loan servicer’s site aspires to be.”

Pulse check on our users

“The most common question we hear is, ‘Should I invest in retirement or pay off loans’?”

“More options than there were years ago: income-driven repayment plan, public service loan, forgiveness, Refinancing, Consolidating, Forbearance”

“Users feel embarrassed, stressed, frustrated, and that talking to us is their last resort”

— ASA Counselors

42.27% of our members have increased their monthly loan payment since they started receiving their employer’s PayDown contributions.

53.63% of members feel that their PayDown contribution has eased their stress about student loan payments

74.12% of members are happier at their company because they offer a Student Loan PayDown Plan.

— Employee satisfaction survey

(n=537)

“"Missing those payments destroyed my credit score“

"Loans are a monster you never want to touch“

“Fun to see the numbers drop each month"

"I'll deal with this later, knowing I'd consolidate and refi [my loans] after [the contribution program benefit"]“

“Which I had been more thoughtful about it"

— User Interviews

(n=5)